- WHICH BILLS SHOULD I PAY OFF FIRST HOW TO

- WHICH BILLS SHOULD I PAY OFF FIRST SOFTWARE

- WHICH BILLS SHOULD I PAY OFF FIRST SERIES

- WHICH BILLS SHOULD I PAY OFF FIRST FREE

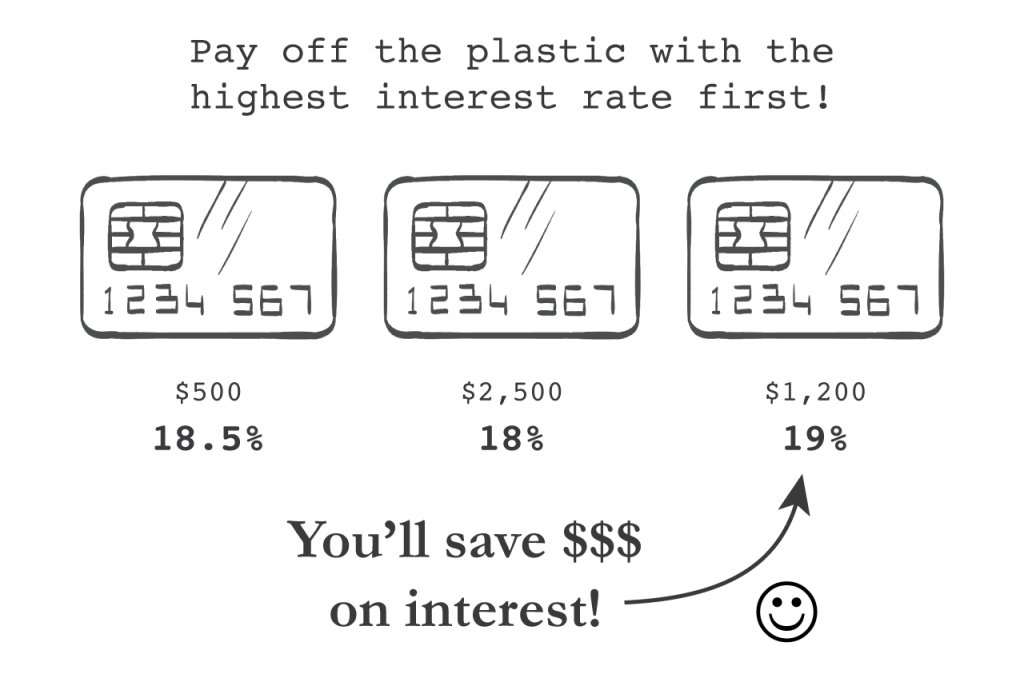

If you have a personal loan (or are considering one), you can use our calculator below to estimate your monthly payments. Write them all down or create a spreadsheet and note the interest rate on each. Take stock of all your sources of debt, including all credit cards and all types of loans (student loans, auto loans, mortgage, personal loans, etc.). While you certainly want to make the minimum payments on all cards to avoid a negative impact on your credit score, if you have multiple sources of debt it’s worth taking some time to figure out the most effective strategy for your budget. Once you’ve done everything you can with your credit card issuers, it’s time to make a plan for paying off your debt.

WHICH BILLS SHOULD I PAY OFF FIRST HOW TO

Learn More: How to Negotiate a Lower Credit Card Interest RateĬonsider this if you’re just starting to figure out your credit card debt payoff solution. You’re more likely to get a good result if you indicate you’re looking for low-interest credit cards from other companies. In some cases, you might be able to secure a lower interest rate, temporary payment reduction, or change in payment due date. You should make sure you’re up to date on all of your balances and also ask what your options are as far as any help they can offer.

Luckily, there are many resources that can help you learn how to pay off credit card debt as fast as possible, so you can save money. NMLS # 1681276, is referred to here as "Credible."Īlthough credit card debt can be quite easy to get into, the high interest rates can make it hard to get out of.

Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. The NCLC advises that you should never pay your lower priority debt, like a credit card bill, in placement of your high priority debt, such as your mortgage.Our goal is to give you the tools and confidence you need to improve your finances. For example, Capital One cardholders may receive fee suppression and minimum payment assistance, while Chase defers payments, waives fees and increases credit lines for those affected by coronavirus.

WHICH BILLS SHOULD I PAY OFF FIRST SERIES

A series of missed payments can hurt your credit score over time, but there is likely financial hardship assistance in place right now that you can take advantage of. If you have an outstanding balance on a credit card, such as your Chase Freedom® or Capital One Platinum Credit Card (see rates and fees), contact the respective card issuers before missing a bill payment. Paying these debts aren't as urgent, as the consequences will not impact your immediate well-being. However, if you're putting them on hold you'll want to let your lender know and prepare to possibly pay extra in fees. Your low priority bills are those that you pay once you've covered your other higher priority bills.

WHICH BILLS SHOULD I PAY OFF FIRST FREE

Investing +More All Investing Best IRA Accounts Best Roth IRA Accounts Best Investing Apps Best Free Stock Trading Platforms Best Robo-Advisors Index Funds Mutual Funds ETFs Bonds Help for Low Credit Scores +More All Help for Low Credit Scores Best Credit Cards for Bad Credit Best Personal Loans for Bad Credit Best Debt Consolidation Loans for Bad Credit Personal Loans if You Don't Have Credit Best Credit Cards for Building Credit Personal Loans for 580 Credit Score Lower Personal Loans for 670 Credit Score or Lower Best Mortgages for Bad Credit Best Hardship Loans How to Boost Your Credit Score

WHICH BILLS SHOULD I PAY OFF FIRST SOFTWARE

Taxes +More All Taxes Best Tax Software Best Tax Software for Small Businesses Tax Refunds Small Business +More All Small Business Best Small Business Savings Accounts Best Small Business Checking Accounts Best Credit Cards for Small Business Best Small Business Loans Best Tax Software for Small Business Personal Finance +More All Personal Finance Best Budgeting Apps Best Expense Tracker Apps Best Money Transfer Apps Best Resale Apps and Sites Buy Now Pay Later (BNPL) Apps Best Debt Relief Best Mortgages for Average Credit Score.Best Loans to Refinance Credit Card Debt.

0 kommentar(er)

0 kommentar(er)